No-Till Farmer’s annual benchmark survey received 480 responses from growers in the U.S. and Canada.

Results showed the ongoing strength of the no-till movement as the 60th anniversary of the commercial launch of the practice will be marked later this year.

Cover crops were applied to fewer acres this year, but farmers using the practice applied them to more land.

Growers also appeared ready to evaluate biologicals’ potential in 2022.

No-Till Approaching 60 Years

Farmers in this year’s survey didn’t report the largest average farm size in acres.

That distinction belongs to the 2019 edition of the benchmark survey. However, this year’s survey tallied the second-highest average farm size at 1,365, the second-largest percentage increase (17%), and the third-largest swing since 2015. The largest jump in average acres was 26.3% between the 2017 and 2018 growing seasons, followed by the second-largest swing between the 2018 and 2019 growing seasons, when the average acreage dropped 25.3%.

Farms showed increases in the averages of all types of land. Land ownership jumped 20.9% from 2020, and increased about 2% from ownership share. Cash rent land increased 10.7%, but decreased its share of farmed land by about 1.2% from 2020 (34.7%) to 2021 (33.5%). Share cropping increased 12.7%, and lost a fraction of its share of total land at 32% from 32.8%.

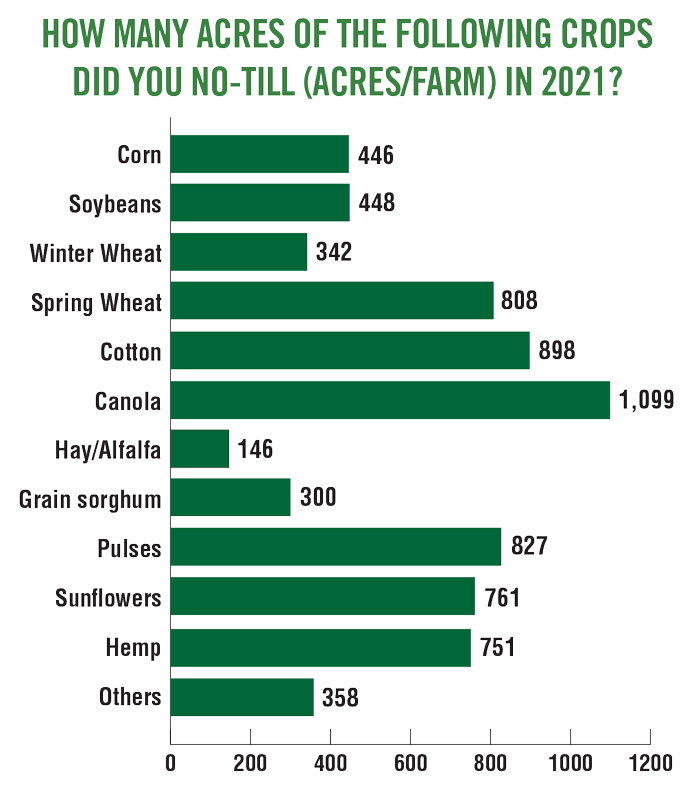

The average farm also grew 446 acres of no-till corn in 2021, a 9% increase from 2020. Soybeans were also up: no-till beans increased 5.9% to 448 acres from 2020 to 2021, according to respondents. Comparisons were hard to come by for some crops: 2021 was the first season the benchmark survey included winter and spring wheat (342 acres average for winter wheat, and 808 average acres for spring). New crops included this year include cotton (898 acres average), canola (1,099 acres average), hay and alfalfa (146 acres average), grain sorghum (300 acres average), pulse crops (827 acres average), sunflowers (761 acres average), hemp (751 acres average) and others (358 acres average).

While canola tallied the largest average no-till acreage, a single Alberta farmer reported no-tilling 7,000 acres of canola (and also 7,800 acres of no-till spring wheat), one of only 11 farmers to report no-tilling canola. More telling, only about 3.8% of all grower respondents reported growing any canola at all.

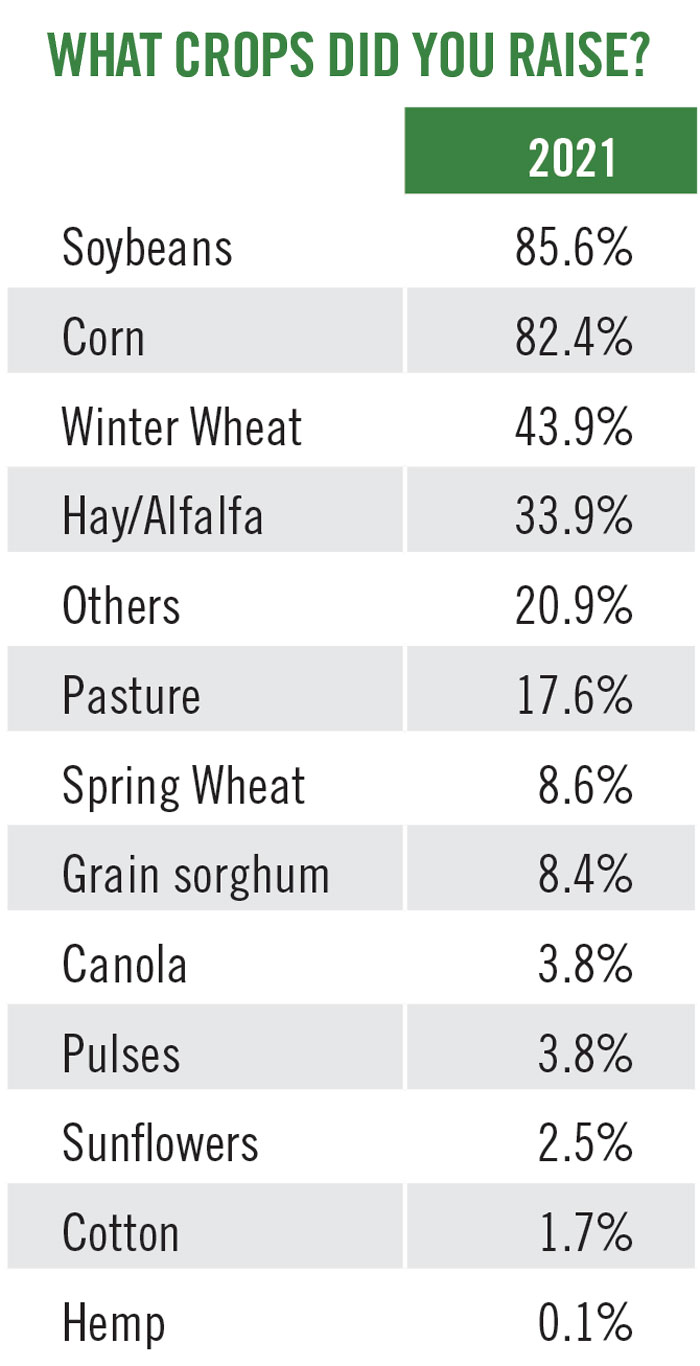

Soybeans were the most commonly reported crops at 85.6%, followed by corn at 82.4%, winter wheat at 43.9%, hay or alfalfa at 33.9%, others at 20.9%, pasture at 17.6%, spring wheat at 8.6%, grain sorghum at 8.4%, canola and pulse crops at 3.8% each, sunflowers at 2.5%, cotton at 1.7%, and hemp at 0.1%.

THE CANOLA CONUNDRUM. While canola appears to be leading the no-till acreage derby, the long bar above is attributable to both a small number of farmers (11) and one 7,000-acre no-till crop reported by a Manitoba farmer.

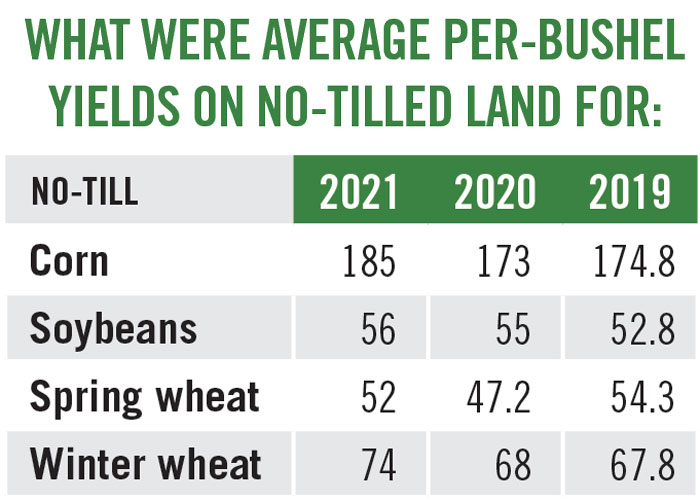

Respondents reported increased yields in 2021 across all crops monitored in the survey. Spring wheat yields increased by about 10% between 2020 and 2021 from 47.2 bu./ac. to 52 bu./ac. Winter wheat increased from an average 68 bu./ac. to 74 bu./ac. Soybeans increased modestly from 55 to 56 bu./ac. No-till corn went up from 173 bu./ac. in 2020 to 185 bu./ac. in 2021.

Organic no-till production grew an incredible 600% in from 2020 to 2021, mostly on the back of a single Manitoba farmer who reported 4,000 organic acres. Even once that admittedly large increase is removed from the calculation, organic acres grew about 300% between 2020 and 2021.

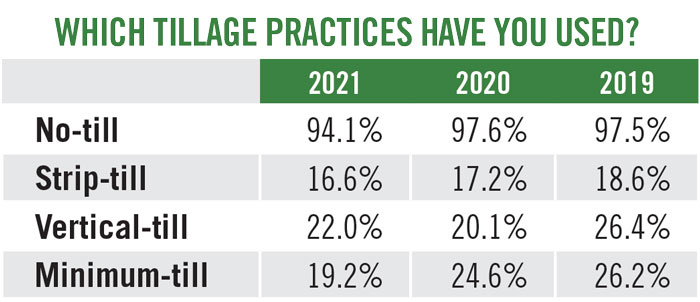

UP AND DOWN. Vertical tillage was the lone practice to show an increase for 2020-21. Other practices showed slight decreases in reported use.

Respondents reported less livestock in most categories measured by the study between 2020 and 2021. The steepest decline was in the “other” category, which declined 5.6%. Respondents reported smaller declines in beef (3.5%), dairy (0.2%), pigs (1.7%) and poultry (0.2%). Sheep held even at about 3%.

These declines came after larger numbers of respondents reported increases each year for 2018-20.

Cover Crops Down Overall, But …

The number of farmers reporting cover crop use also dwindled, from 81.5% in 2020 to 76.9% in 2021. It’s the first year-over-year decline since a 2017-2018 dropoff, and the largest decline on record, though the 6.1% 2016-17 increase remains the largest swing in any direction since 2014. Moreover, total cover crop acres also decreased to 193,344 from 239,818 between the two years (a 14% decrease).

However, respondents also reported an average of 509 acres in 2021, up from 487 in 2020 results, an increase of about 5%.

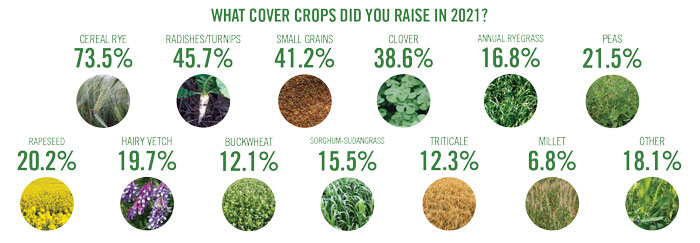

Cereal rye retained its spot as the most popular cover crop species, at 73.5% of 2021 covers planted among respondents. Cereal rye jumped almost 8% from 2020

Among farmers who did plant covers, multispecies blends grew in popularity. About 77% of respondents reported blend use in 2021, a 5.8% jump from 2020. The increase comes after an 8.7% falloff for 2019-20, which followed single-digit percentage increases every year starting in 2016.

Grazing livestock on covers was marginally more popular among respondents this year, up to 26.3% from 22.4% in 2020. The 2021 figure is a record high since the benchmark survey began tracking the practice in 2018, when respondents reported grazing rates of 14.7% on all cropland, though responses indicate the practice is still relatively rare.

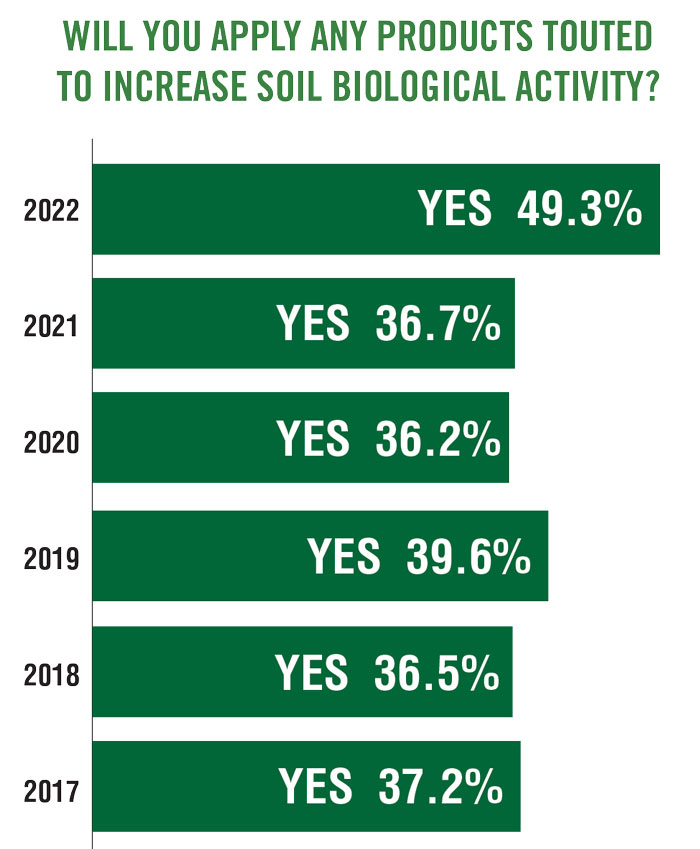

BIO BANG MAYBE? After years with moderate interest in biologicals, 49% of respondents plan to use them this year.

Nutrient Management and Biologicals

Biological soil boosters have been recorded in the benchmark since plans for the 2017 growing season, when growers reported 37.2% of respondents said they were planning to apply a product touted to increase soil biological activity. The number has stayed fairly stable in the high 30’s until this year.

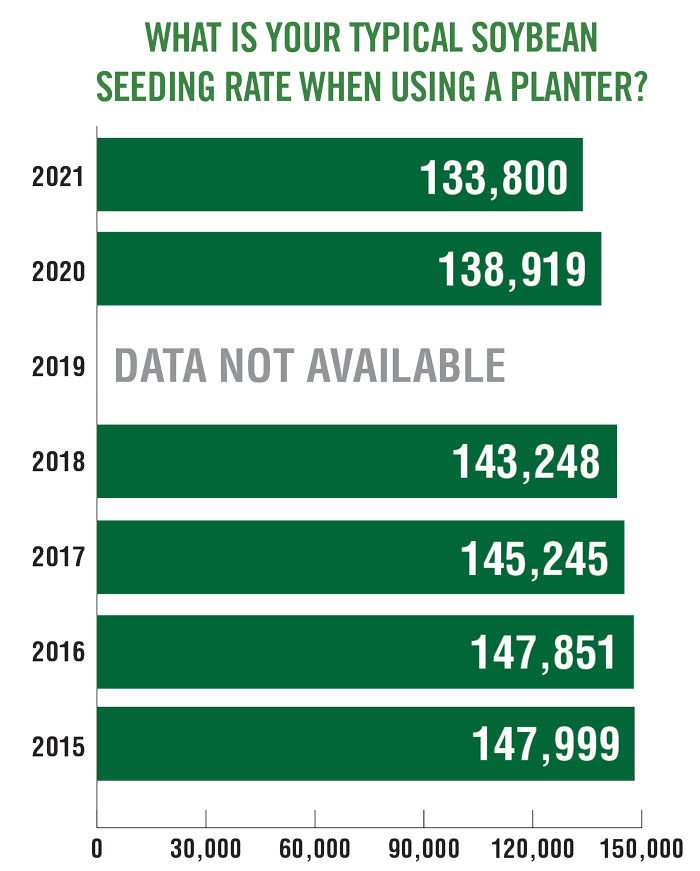

PLANTER RATES DOWN. Planter populations showed continued decrease, amid reported higher yields.

About 49% of respondents — almost half — say they plan to use biological agents this year. That’s an increase of 12.6 percentage points, after years of single digit swings, both increases and decreases. For the four years the benchmark survey has monitored plans relating to biologicals, the largest movement was a 3.4 point decrease in the percentage of growers who said they planned to use biologicals between 2019

and 2020.

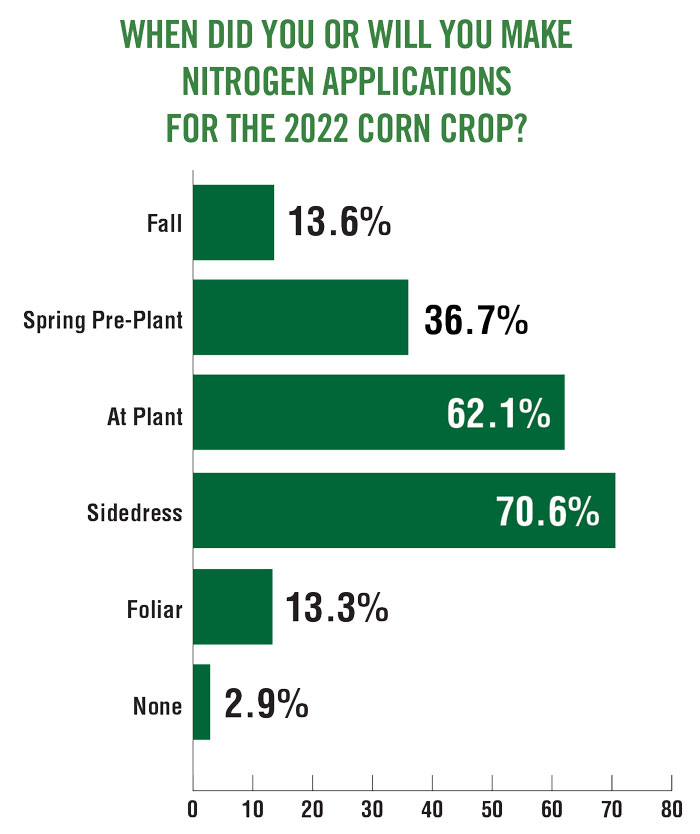

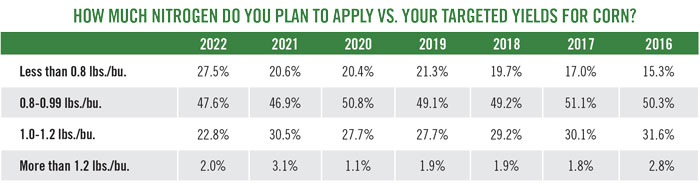

THE NTH DEGREE. Most respondents were focused on targeted applications amid blistering N prices.

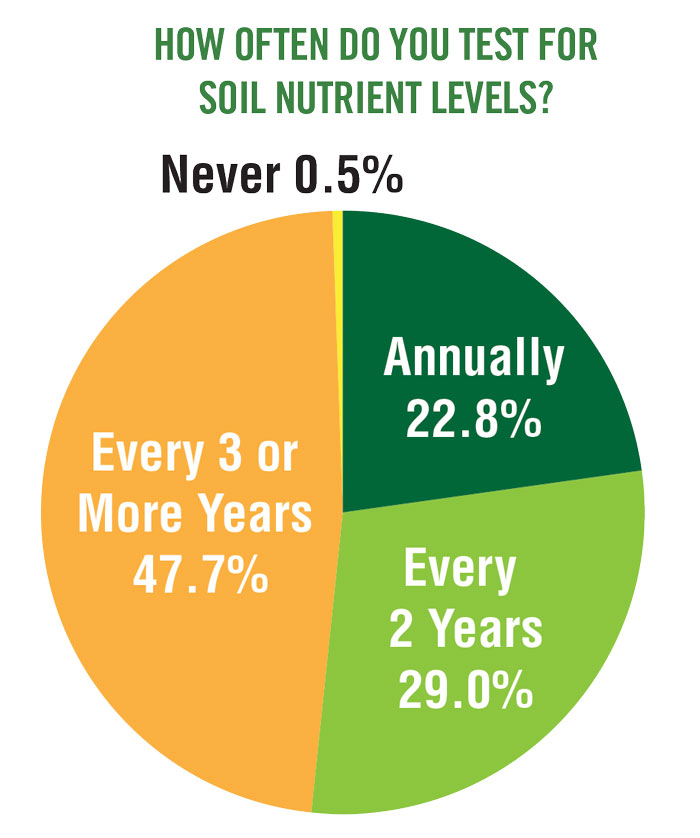

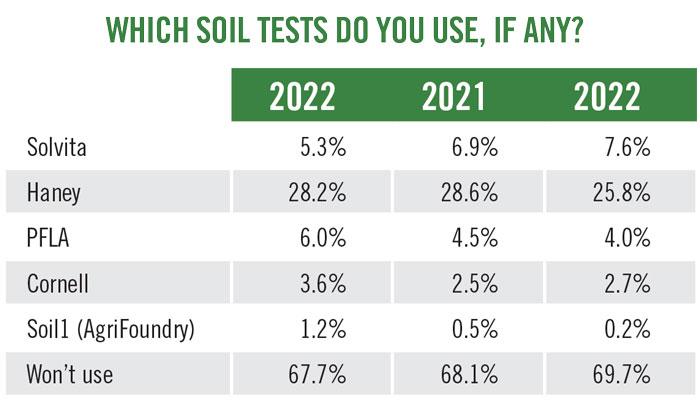

And while academics and manufacturers recommend increased soil testing to determine needs for specific biologicals, the number of growers who say they plan to test annually remains less than a quarter (22.8%). Instead, the largest percentage of respondents was the 47.7% of growers who said they planned to test every three or more years.

The increased interest in biologicals also comes as domestic and global factors conspire to push up inputs.

CUT WITHOUT MEASURE? While interest in soil biology is high, more than three-quarters of respondents say they’re conducting soil tests every other year or less frequently.

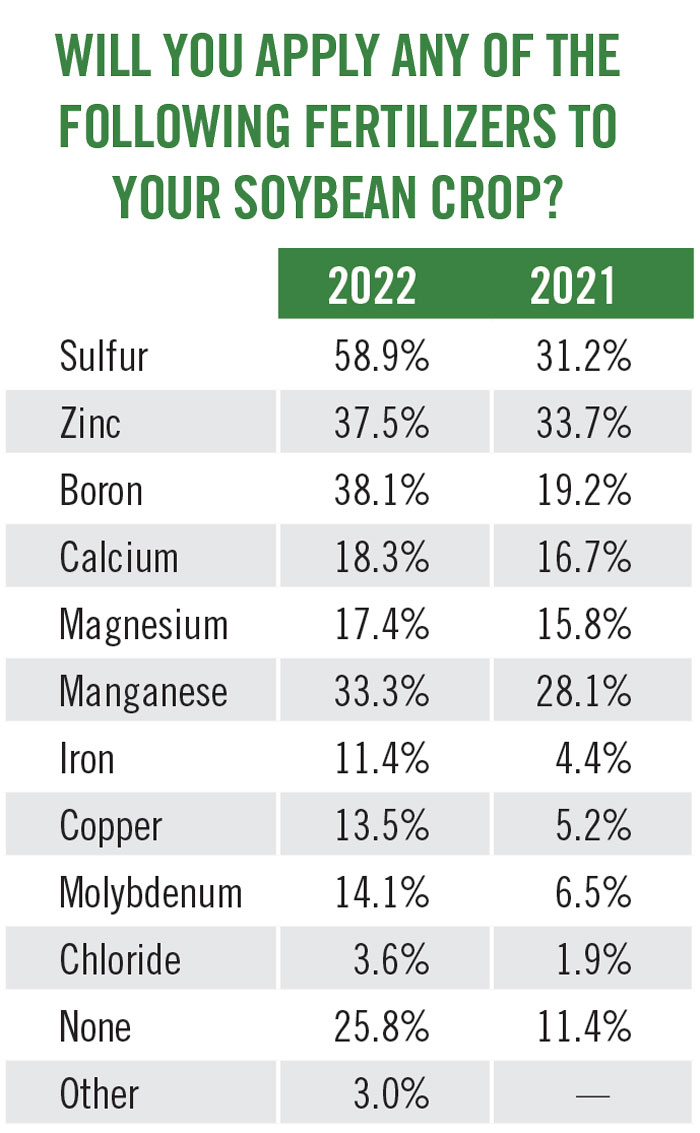

The trend is most pronounced for soybeans.

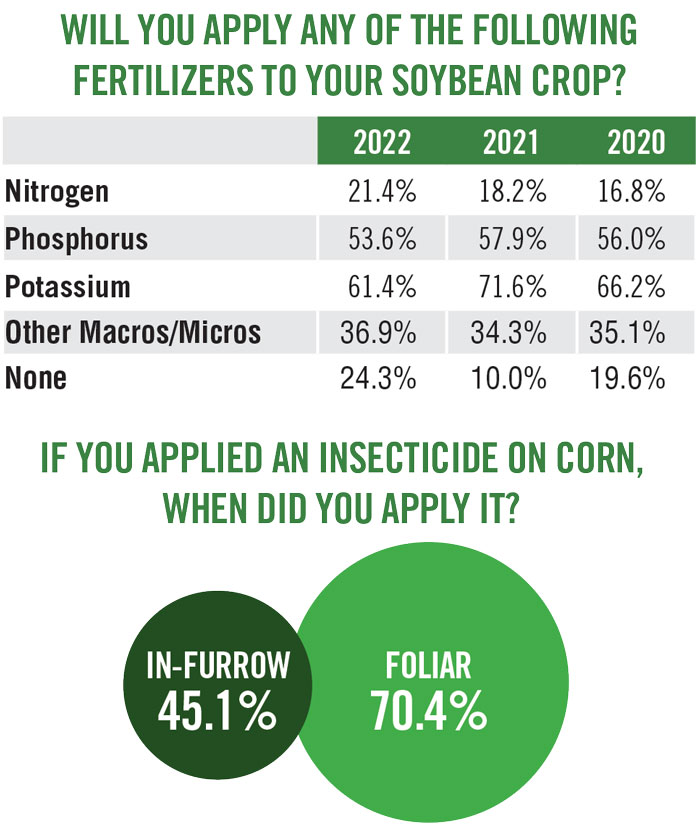

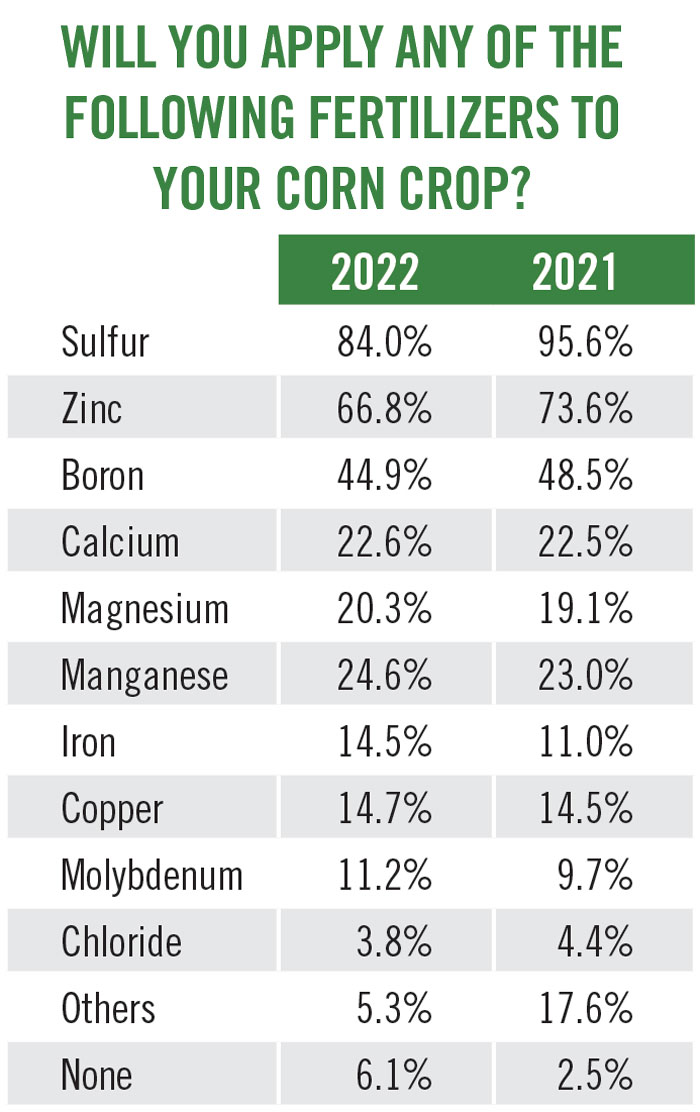

About 21.4% of respondents say they’ll fertilize with nitrogen this year, an increase of 3.2 points. Phosphorus showed a similar swing, a 4.3 point decrease in the percentage of growers who say they will apply phosphorus. Potassium, which saw a price spike amid U.S. sanctions against the major potash exporter Belarus, showed a double-digit decrease, from 71.6% of respondents who said they planned to apply K in 2021, compared to 61.4% who planned K applications in 2022.

However, the largest swing of any kind was in the percentage of people who said they planned to add none of the major nutrients to their soybeans, which jumped to 24.3%.

Post a comment

Report Abusive Comment